Why Modern Insurance CX Requires Cobrowsing, Not Just Chat and Phone

February 03, 2026

Samesurf is the inventor of modern co-browsing and a pioneer in the development of foundational systems for Agentic AI.

The insurance industry is undergoing a profound digital transformation. Today’s policyholders expect seamless, intuitive, and immediate support across property and casualty, health, and life insurance lines. Traditional customer service channels are no longer sufficient to meet these expectations, particularly when navigating complex workflows like claims submission, quote generation, document uploads, or interpreting detailed policy language. Customers demand clarity, efficiency, and reassurance, especially when engaging with portals that contain sensitive financial or medical information.

To meet these expectations, insurance providers need more than conversational guidance; they need cobrowsing, a technology that allows real-time, interactive, browser-based assistance. Samesurf, the inventor of cobrowsing, has built a platform specifically designed to address the unique challenges of the insurance customer experience, enabling agents to provide high-touch guidance without ever compromising privacy or compliance.

The Limitations of Traditional Support Channels

Historically, insurers have relied heavily on phone and chat support to guide customers through policies, claims, and enrollment processes. While these channels remain useful for basic inquiries, they struggle when customers face multi-step digital workflows that require precision and understanding.

Phone support presents a fundamental problem: agents cannot see what the customer sees. A policyholder may struggle with navigating a claims portal, filling out a life insurance rider, or uploading sensitive documents, while the agent relies solely on verbal descriptions. Miscommunications are common:

- “I don’t see the button you mentioned.”

- “Where exactly do I upload my supporting documents?”

- “I’m confused about this deduction; which one do you mean?”

Even with patient guidance, these interactions often result in longer handling times, incomplete submissions, or repeated calls and emails.

Text-based channels, including live chat and chatbots, improve accessibility but still cannot convey visual context. Explaining a multi-step quote form, a claims workflow with conditional logic, or a detailed policy page over chat can be slow and error-prone. Critical information can be misread or misunderstood, and customers may make mistakes that require corrections after submission.

The underlying problem is clear: without shared visual context, agents cannot provide fully effective guidance. Samesurf cobrowsing closes this gap by allowing agents to interact directly with the same web page the customer sees, in real time, without ever exposing sensitive data.

How Cobrowsing Enhances the Insurance Customer Experience

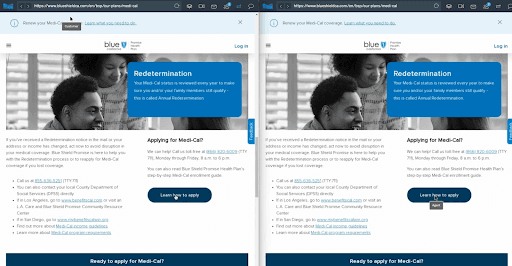

Cobrowsing, as pioneered by Samesurf, transforms insurance customer interactions by creating a shared, interactive experience in the customer’s browser. Unlike traditional screen sharing, Samesurf synchronizes the underlying web page structure rather than streaming pixels, delivering a responsive, secure, and fully interactive experience.

This technology is particularly valuable for insurance workflows that are often complex, high-stakes, and sensitive:

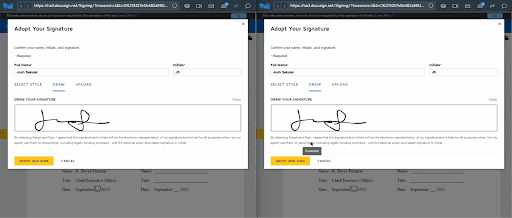

- Claims Guidance: Filing a claim requires navigating multiple forms, submitting supporting documents, and referencing policy-specific language. With cobrowsing, agents can highlight required fields, show exactly where to upload documentation, and guide customers step by step through the process, all while sensitive data remains hidden from the agent. This reduces errors, accelerates claim submission, and minimizes customer frustration.

- Quote Assistance: Insurance quotes often involve multiple coverage options, deductibles, riders, and premiums. Cobrowsing enables agents to walk customers through the quote process visually, ensuring accurate input, clarifying complex plan differences, and helping customers make informed decisions without guesswork. By showing exactly what the agent is referencing, cobrowsing reduces confusion and builds confidence.

- Document Upload Support: Document uploads are a frequent source of delays in insurance workflows. Whether submitting medical records, vehicle photos, or policy attachments, customers often struggle with file types, size limits, or portal navigation. Cobrowsing allows agents to guide customers in real time, ensuring uploads are completed correctly and reducing the need for follow-up interactions.

- Policy Explanation: Insurance policies contain dense, technical language, including terms, exclusions, and coverage details. Cobrowsing allows agents to highlight specific sections, explain coverage nuances, and clarify terms visually. Customers can follow along on the same page, reducing misunderstanding and enhancing comprehension.

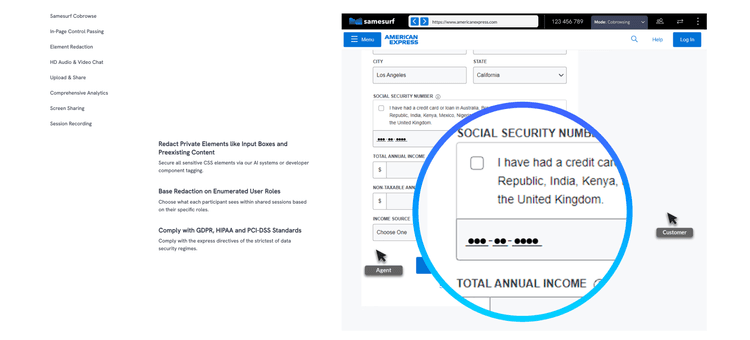

Since Samesurf cobrowsing is designed with security in mind, sensitive data such as social security numbers, medical information, or financial account numbers can be masked or blocked from agent view. This ensures compliance with HIPAA, PCI, and other regulatory standards, while still enabling comprehensive guidance and support.

Reducing Errors, Improving Resolution, and Enhancing Customer Confidence

For insurance providers, errors and incomplete submissions are costly. Every incorrect claim, incomplete form, or misfiled document requires follow-up, rework, and additional administrative effort. Cobrowsing directly addresses these challenges by enabling agents to intervene in real time, spotting potential errors before they become problems.

With cobrowsing, agents can:

- Verify that forms are filled out correctly.

- Ensure documents are uploaded in the proper formats.

- Clarify policy selections and coverage options.

- Guide customers through complex steps that would otherwise lead to confusion or mistakes.

The result is measurable: reduced handling times, fewer errors, and higher rates of first-contact resolution. Customers experience smoother interactions and greater confidence that their claims, quotes, and policy adjustments are handled correctly the first time.

Security, Compliance, and Operational Control

Insurance workflows involve highly sensitive information, making security a critical concern. Samesurf cobrowsing incorporates features specifically designed for compliance and operational safety:

- Input Field Blocking: Agents can provide guidance without accessing sensitive fields, such as social security numbers, banking details, or protected health information.

- Redaction and Masking: Critical data can be hidden from the agent while still enabling real-time guidance.

- Single-Tab Sharing: Agents only interact with the relevant portal tab, reducing exposure to unrelated data and mitigating risk.

These controls allow insurers to deliver high-touch customer support while maintaining compliance with HIPAA, PCI, and other regulatory requirements, a crucial factor in health, life, and P&C insurance.

Why Cobrowsing Is Becoming Essential for Insurance CX

The insurance customer experience is evolving. Policyholders expect more than verbal or textual guidance; they require visual, real-time support that bridges the gap between complex digital portals and human expertise. Cobrowsing achieves this by:

- Reducing errors and incomplete submissions.

- Improving first-contact resolution.

- Shortening handling times for claims, quotes, and document uploads.

- Increasing customer satisfaction and trust.

- Enhancing agent efficiency and productivity.

By incorporating Samesurf cobrowsing, insurers can provide a modern, intuitive, and secure customer experience that meets these evolving expectations. Agents can guide customers visually, clarify complex policy pages, assist with sensitive document uploads, and ensure that critical forms are completed accurately without exposing sensitive information.

Redefining Insurance Interactions

The insurance industry cannot rely solely on phone calls or chat to deliver a competitive customer experience. The complexity of claims, quotes, document management, and policy comprehension demands a solution that is both human-centered and digitally precise.

Samesurf cobrowsing provides that solution. By enabling real-time, secure, and interactive guidance, insurers can reduce errors, accelerate resolution, improve first-contact outcomes, and build trust with customers navigating sensitive and complex insurance workflows. For P&C, health, and life insurance providers, cobrowsing is no longer a value-added feature; it is an essential tool for delivering modern, efficient, and compliant customer experiences.

With Samesurf cobrowsing, insurers can meet customer expectations, streamline operations, and redefine what excellent insurance customer experience looks like in the digital age.

Visit samesurf.com to learn more or go to https://www.samesurf.com/request-demo to request a demo today.