Simplifying Personal Finance with Samesurf Cobrowse

July 30, 2025

Samesurf invented modern co-browsing.

The world of personal finance is more complex than ever. From budgeting tools and savings platforms to retirement planning and debt management, consumers rely on digital services to manage their financial well-being. However, these platforms often come with steep learning curves and limited support options, which can leave users feeling overwhelmed or discouraged.

Samesurf Cobrowse is bridging this gap by delivering real-time, secure and personalized assistance that empowers both consumers and financial institutions. Whether it’s walking a customer through a loan application, helping them set up auto-pay, or explaining the details of a budgeting dashboard, Samesurf Cobrowse transforms passive support into guided, interactive real time collaboration.

By eliminating friction and building trust in every interaction, Samesurf Cobrowse is redefining how personal finance tools engage, support and retain customers in a digital-first economy.

Why Personal Finance Needs a Human Touch

While financial technology continues to evolve at a rapid pace, many consumers still struggle to navigate it effectively. Online banking interfaces can be confusing. Budgeting tools may feel overwhelming. Loan applications are often filled with jargon. For more mature users or those unfamiliar with digital platforms, even simple tasks like setting up direct deposit can become barriers.

Traditional support methods like phone calls or email tickets often make things worse. It is difficult for agents to understand what the customer sees, and even harder for customers to describe technical issues. As a result, financial service providers risk customer dissatisfaction, abandoned applications, and missed opportunities.

Samesurf Cobrowse addresses these challenges by creating a shared digital environment where agents and customers can see, scroll and interact with the same webpage or content in real time. This collaborative approach brings the personal touch back to digital finance.

What is Samesurf Cobrowse?

Samesurf Co‑browsing, short for collaborative browsing, empowers agents, AI users and customers to navigate the same online content in real time without installs, downloads or IT involvement of any kind.

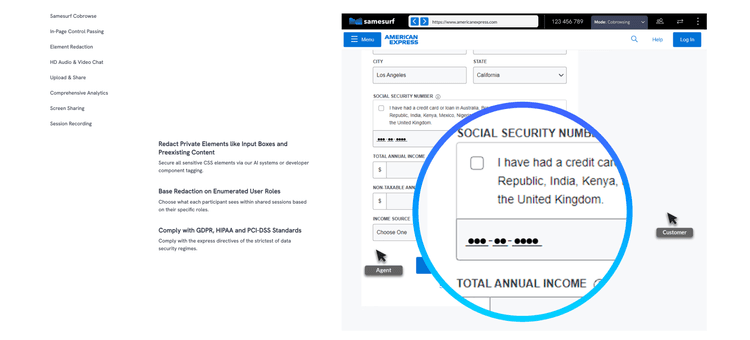

This method safeguards security via enterprise‑level encryption, single (or multiple tab) browser sharing and screen redaction for sensitive screen & input elements. Unlike typical (and risky) screen sharing systems, Samesurf cobrowse makes collaboration precise, secure and integrated directly within banking web experiences.

Real-World Use Case: Using Samesurf Cobrowse to Guide a Credit Card Application

Imagine a customer visits a bank’s website to apply for a new credit card. They get halfway through the form but get stuck on questions about income verification and document uploads. Frustrated, they call customer support.

Instead of trying to describe what the customer is seeing, the agent invites them to start a Samesurf Cobrowse session. Within seconds, they are on the same page in real-time. The agent explains what information is needed, and walks the customer through the entire verification process.

No downloads are required and personal data remains fully protected. The result is a secure, seamless and collaborative experience. With guided support throughout every single step, the customer completes the application confidently and leaves with a positive impression.

Key Use Cases for Samesurf Cobrowse in Personal Finance

1. Account Setup and Onboarding

New users often need help setting up their online banking accounts or connecting third-party budgeting tools. With Samesurf Cobrowse, support teams can walk them through every step of the process in real time.

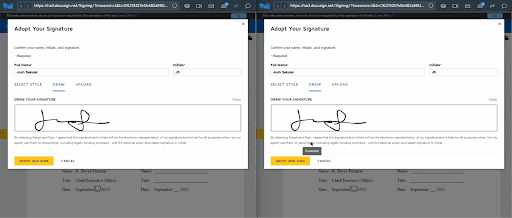

2. Loan and Credit Applications

From auto loans to home equity lines of credit, financial applications are detailed and often confusing. Samesurf Cobrowse allows advisors to (1) assist customers during the application; (2) explain terms; (3) complete e-signature documents; and (4) answer questions as they arise.

3. Retirement and Investment Planning

Financial planning tools are powerful but complex. Advisors can use Samesurf Cobrowse to guide clients through dashboards, compare retirement options, or clarify fee structures without the need for in-person meetings.

4. Bill Pay and Budgeting Assistance

Setting up recurring payments or configuring a monthly budget tool can be daunting for less tech-savvy users. Samesurf Cobrowse provides real-time coaching, turning frustration into empowerment.

5. Security and Fraud Resolution

When customers suspect fraud or need to reset credentials, time and clarity are essential. Samesurf Cobrowse helps agents resolve these issues quickly by navigating directly with the user, while keeping all sensitive information hidden.

Why Samesurf Cobrowse Stands Out

While there are many support tools available, most are not built for the unique demands of personal finance. Samesurf Cobrowse offers key advantages that set it apart:

- Zero Downloads

There is nothing to install. Sessions start instantly from any browser. - Mobile-First Compatibility

Samesurf Cobrowse works seamlessly on smartphones and tablets, making it perfect for users who manage their finances on the go. - Privacy by Design

Built-in screen redaction and access controls ensure that private financial data remains protected throughout the session. - Non-Invasive Platform

Unlike screen sharing, Samesurf Cobrowse allows agents to guide and highlight without taking over the user’s device, preserving comfort and security. - Compliance Ready

Samesurf Cobrowse supports compliance with financial regulations like GDPR, PCI-DSS, and others, making it a safe choice for banks, credit unions, and fintech platforms.

Driving Loyalty Through Better Digital Engagement

Financial institutions are under pressure to compete not just on rates or products, but on customer experience. As more services move online, the ability to offer fast, helpful and secure support is a key differentiator.

Samesurf Cobrowse helps financial service providers create standout digital experiences that build trust and loyalty. When customers feel supported, they are more likely to adopt new tools, stay with a provider and refer others.

Whether helping a first-time user open a checking account or assisting a retiree with investment questions, Samesurf Cobrowse makes every interaction more human and effective.

Seamless Integration and Scalable Deployment

Samesurf Cobrowse can integrate directly into websites, apps and online portals. It also integrates with popular CRMs, help desks, and chat platforms, making it easy to incorporate into existing workflows.

Whether you are a regional credit union or a global fintech company, Samesurf Cobrowse scales with your business. Support teams can handle multiple sessions simultaneously, and performance remains smooth across all devices.

Conclusion: Samesurf Cobrowse Elevates the Personal Finance Experience

Managing money is personal. It requires trust, clarity, and support. In today’s digital world, financial service providers must go beyond basic customer service to deliver truly engaging and effective experiences.

Samesurf Cobrowse is leading the way by turning static support into dynamic collaboration. It empowers customers, enhances agent productivity, and ensures security at every step. From account onboarding to investment planning, it delivers the tools financial institutions need to succeed in a competitive, digital-first environment.

Visit samesurf.com to learn more or go to https://www.samesurf.com/request-demo to request a demo today.