Samesurf for Risk Management in Finance and Healthcare

October 21, 2025

Samesurf is the inventor of modern co-browsing and a pioneer in the development of core systems for Agentic AI.

Samesurf co-browsing is transforming how finance and healthcare organizations handle regulatory compliance. By giving agents a shared, visual interface, co-browsing ensures customers fully understand complex legal disclosures, fundamentally reducing financial and legal risk.

Samesurf’s co-browsing technology operationalizes compliance by enabling verifiable informed consent, accurate data handling, and tamper-proof audit trails. Instead of passively presenting documentation, organizations can demonstrate real-time engagement and understanding, which makes compliance active and accountable.

For compliance leaders and operations executives, Samesurf co-browsing turns regulatory obligations into a proactive process that safeguards the organization while improving the customer experience.

Samesurf Co-browsing and the Cost of Disclosure Failure in Finance and Healthcare

Global financial and healthcare regulations are increasingly focused on ensuring customers truly understand disclosures, not just that documents were provided. Static text often fails to communicate complex legal concepts effectively, which creates risk of non-compliance and significant financial penalties.

Samesurf co-browsing addresses this gap by giving agents a shared visual interface to guide customers through critical documents and processes. In finance, co-browsing helps prevent errors in anti-money laundering checks, customer identity verification, and truth-in-lending disclosures, reducing both consumer compliance risk and broader systemic risk. In healthcare, it ensures accurate informed consent and HIPAA compliance by documenting real-time guided engagement, providing a verifiable audit trail that can protect against severe fines and legal exposure.

By transforming compliance from passive documentation into an interactive, demonstrable process, Samesurf co-browsing helps organizations mitigate regulatory risk while improving customer understanding and trust.

Samesurf Co-browsing Architecture as the Foundation of Regulatory Security

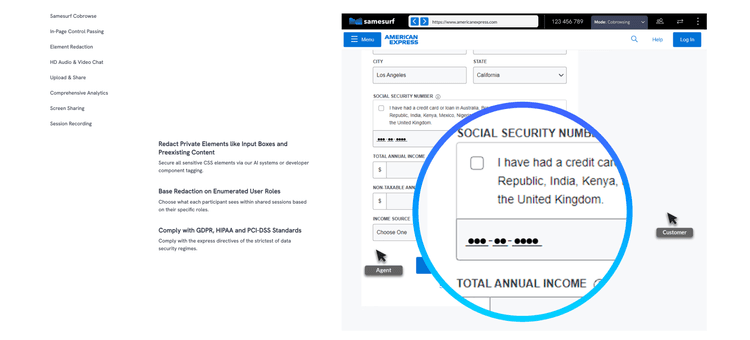

Deploying co-browsing in regulated industries depends on strict adherence to global security and data handling standards. Samesurf co-browsing provides the architectural assurance required by compliance and risk officers to safely manage sensitive customer interactions.

Platforms must meet international security and privacy standards, including GDPR and ISO 27001, which demonstrate robust controls over data processing, security management, and risk mitigation. These frameworks establish a reliable foundation for handling sensitive financial and healthcare interactions.

For healthcare, HIPAA compliance is mandatory. Integrating Samesurf co-browsing requires a Business Associate Agreement, which legally binds the vendor to protect patient information. This contractual framework ensures that Protected Health Information is handled securely, making the platform fully compatible with healthcare compliance programs.

In financial services, the protection of cardholder and transaction data is critical. Samesurf co-browsing adheres to PCI-DSS requirements and maintains SOC 2 Type 2 certification. SOC 2 Type 2 demonstrates continuous, third-party audited verification of security controls, giving banks and insurers a strong, verifiable defense against compliance failures.

A key feature of compliant co-browsing is selective viewing and redaction. Agents can provide real-time guidance without accessing or recording sensitive information such as credit card numbers or Social Security data. Clients can self-host sessions and leverage robust redaction tools, ensuring maximum control over sensitive data. This selective viewing capability is essential for maintaining compliance in both PCI-DSS and HIPAA environments and transforming co-browsing into a legally and operationally safe tool for regulated interactions.

Mitigating Compliance Risk in Financial Services with Samesurf Co-browsing

Financial services face a constantly evolving regulatory landscape, where consumer protection requirements like TILA-RESPA Integrated Disclosure demand precise, accurate disclosures. Complex mortgage documents, including origination and appraisal fees, are prone to misunderstanding, increasing the risk of non-compliance.

Samesurf co-browsing addresses this by providing agents with real-time visual guidance. During account openings or other processes subject to Know Your Customer and anti-money laundering rules, agents can ensure identity documents and financial data are entered correctly on the first attempt. This reduces errors, miscommunication, and regulatory exposure.

The technology allows agents to detect hesitation or incorrect inputs instantly, turning passive compliance checks into proactive risk mitigation. Clients are guided step by step, ensuring understanding while boosting operational efficiency and lowering error rates. For example, completing complex insurance or mortgage applications accurately not only ensures compliance but also strengthens customer trust, transparency, and overall experience.

Ensuring Verifiable Informed Consent in Healthcare with Samesurf Co-browsing

Healthcare institutions must protect patient privacy while ensuring the flow of critical health information. Traditional digital consent, such as static PDFs, often fails to provide verifiable proof of engagement or comprehension.

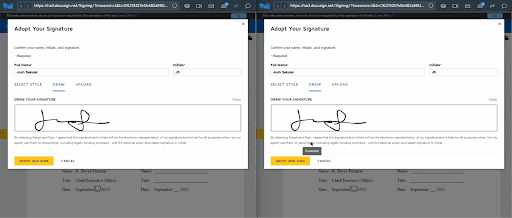

Samesurf co-browsing enhances this process by allowing agents to highlight key sections of consent forms in real time, visually directing patient attention to high-risk or legally critical areas. This ensures users can extract relevant information and make genuinely informed decisions.

By integrating HIPAA-compliant infrastructure, including Business Associate Agreements and SOC 2 security standards, co-browsing transforms passive digital consent into verifiable informed consent. The recorded session provides documented proof of engagement and accuracy, offering healthcare providers strong legal protection against claims of misunderstanding or rushed consent.

Samesurf Co-browsing as Litigation and Regulatory Evidence

Traditional compliance often ends with a customer signing a static PDF, which only proves the document was presented, not that it was read, understood, or actively engaged with. High-risk disclosures in finance and healthcare rely on passive documentation, leaving institutions exposed to disputes and regulatory scrutiny. Samesurf co-browsing solves this problem by creating a dynamic, verifiable record of every interactive session, capturing the client’s engagement and the agent’s guidance in real time.

The platform’s Session Replay records synchronized audio, video, and screen activity, producing a complete, tamper-proof audit trail. Every action, from scrolling to form entry, is documented, providing indisputable proof of compliance and accurate submission. This verifiable evidence shows that agents adhered to compliant scripts while customers actively interacted with disclosures, establishing intent and informed consent.

In high-risk workflows such as mortgage closings under TRID or patient consent in healthcare, this record shifts liability away from the institution, offering clear, defensible proof of proactive customer protection. Unlike static PDFs, Samesurf’s time-stamped recordings capture the full context of engagement, delivering an audit trail that satisfies regulators and legal authorities while demonstrating rigorous operational compliance.

Implementing Samesurf Co-browsing

Enterprises should deploy Samesurf co-browsing for high-risk, high-volume workflows prone to agent or customer error. In finance, this includes TILA/TRID disclosures and mortgage applications; in healthcare, patient intake and complex clinical trial consent forms. Starting with these critical processes delivers a fast Return on Compliance Investment by reducing errors and non-compliant submissions.

Samesurf co-browsing meets rigorous international standards like GDPR, ISO 27001, and SOC 2 Type 2, ensuring compliance systems can adapt to evolving regulations without costly overhauls. Audited, certified controls provide long-term resilience and lower risk exposure.

Combining real-time visual guidance with a tamper-proof audit trail, Samesurf co-browsing transforms compliance from a passive obligation into a strategic, defensible asset. Customer comprehension improves, errors decrease, regulatory adherence strengthens, and compliance becomes a measurable competitive advantage while boosting trust and operational efficiency.

Visit samesurf.com to learn more or go to https://www.samesurf.com/request-demo to request a demo today.