Safeguard Your Finances with Samesurf Co-Browse

June 02, 2025

Samesurf invented modern co-browsing.

The financial services industry currently faces both an opportunity and a challenge: how to maintain personal, trust-based relationships with clients while adapting to rapidly evolving technologies. As clients increasingly turn to online platforms for everything from budgeting and savings to investing and retirement planning, financial institutions must find innovative and secure ways to enhance digital communication. Samesurf Co-Browse is the advanced solution that enables real-time collaboration between financial advisors and clients, preserving the personal touch that builds trust while seamlessly adapting to a digital-first world.

Enhanced Client Engagement and Satisfaction

Financial decisions are rarely straightforward, and clients often seek expert guidance to navigate investment choices, retirement planning and complex documentation. While traditional in-person consultations fostered trust and deeper communication, digital platforms frequently lack the emotional connection and immediacy that clients need. Samesurf Co-browse solves this by letting advisors and clients cobrowse the same digital content in real time, enabling advisors to guide clients through financial tools, forms and documents with precision. This one-on-one collaboration ensures clients feel heard, supported, and valued—enhancing satisfaction and reinforcing long-term loyalty.

Improved Understanding of Complex Financial Products

The financial world is full of specialized language and intricate concepts, terms like ETFs, fixed-income instruments and portfolio diversification can be daunting for many clients. Even with digital tools designed for simplification, navigating these products can lead to confusion. Samesurf Co-browse empowers advisors to demystify these complexities by walking clients through web-based platforms while visually highlighting key sections, calculations, and product comparisons. By actively engaging clients through Samesurf co-browse, advisors can enhance financial literacy, improve understanding and empower clients to make more informed, confident decisions.

Increased Efficiency and Time Savings

Scheduling in-person meetings or even virtual video calls can be time-consuming and inefficient, especially when quick clarification or support is needed. Samesurf Co-browse significantly reduces the time and effort required to resolve issues or complete tasks. Advisors and clients can connect instantly within the same digital interface, eliminating back-and-forth emails or multiple appointment bookings. This streamlined workflow enables advisors to serve more clients effectively while maintaining the quality of service, making Samesurf Co-browse a critical tool for maximizing productivity and reducing operational friction.

Increased Transparency and Trust

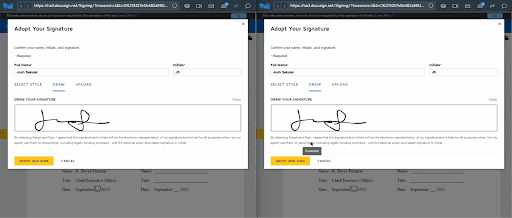

Transparency is foundational to building and maintaining trust in the financial services industry. Clients want to understand how their investments are managed, what fees they’re being charged and how financial decisions are made. Samesurf Co-browse facilitates this transparency by allowing advisors to guide clients step-by-step through portfolio dashboards, transaction histories and financial reports. With Samesurf Co-browse, clients can see the same content as their advisor in real time, ask questions on the spot, and gain a clearer understanding of financial strategies, leading to increased confidence and stronger relationships.

Security and Privacy at the Forefront

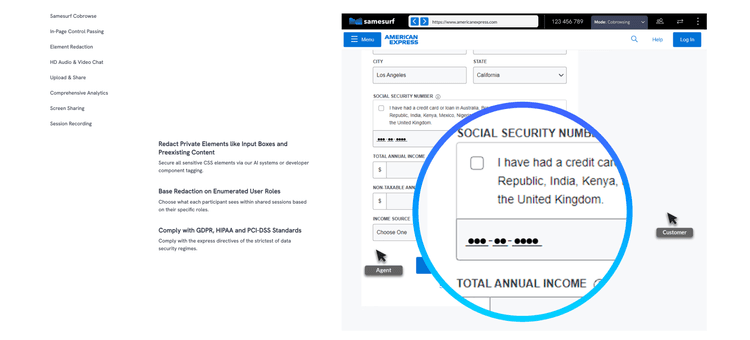

In an era where digital interactions are vulnerable to increasing security threats, protecting sensitive client data is not optional, it’s essential. Financial institutions must ensure that every remote engagement is both secure and compliant. Samesurf Co-browse is designed with privacy and security at its core, a patented solution, real-time collaboration without downloads or installations. It features enterprise-grade protections including end-to-end encryption, dynamic masking of sensitive fields, role-based permissions and auditable session logging. Unlike traditional screen sharing, Samesurf Co-browse never transmits entire screens or desktop content, minimizing risk. These advanced capabilities ensure that financial advisors can deliver personalized, high-touch service while maintaining the highest standards of data privacy, regulatory compliance and client trust.

A Future-Proof Solution for a Digital Age

The next generation of clients (digitally native and tech-savvy) expects immediacy, convenience, and interactivity in every service they use. Financial institutions that fail to meet these expectations risk becoming obsolete. Samesurf Co-browse positions firms to thrive in this digital evolution by delivering seamless, on-demand interactions that mirror in-person engagements. Whether assisting clients through onboarding, addressing account issues, or providing ongoing financial education, Samesurf Co-browse ensures that advisors remain accessible, efficient and relevant in a rapidly changing industry landscape.

In Conclusion

Samesurf Co-browse is redefining the way financial institutions interact with clients by merging the personal connection of traditional advising with the efficiency and reach of digital technology. From enhancing engagement and understanding to streamlining workflows and securing client data, Samesurf Co-browse equips financial advisors with the tools they need to exceed client expectations in today’s competitive environment. By adopting Samesurf Co-browse, firms can deliver personalized, transparent, and efficient service that meets the demands of both current and future clients, ultimately transforming the client experience in the financial services industry.

Visit samesurf.com to learn more or go to https://www.samesurf.com/request-demo to request a demo today.