Personalized Banking with Samesurf Co-Browse

June 09, 2025

Samesurf invented modern co-browsing.

Banks are facing a critical challenge: delivering personalized, high-touch engagement while operating at scale. As more customers choose online and mobile banking over in-person visits, institutions must adapt to expectations for real-time assistance without sacrificing relationship building. Samesurf Co‑Browse is a powerful solution that blends visual engagement, security and human connection into banking support and sales.

Why Personalized Banking Matters

The financial industry is rapidly evolving and no longer are low interest rates or digital statements enough to retain customers – personalized service is the new frontier. Consumers expect banks to understand their unique goals, walk them through complex processes and respond instantly when issues arise. And while chatbots and FAQs are somewhat helpful, they can’t replicate the assurance of “being together” through a tricky transaction or intricate form.

A recent Samesurf blog underscores that a “customer‑centric approach is crucial for building trust and fostering loyalty.” Personalized support helps customers feel secure and understood, leading to positive experiences, repeat business, and improved retention. It’s precisely what financial institutions need as they transform digitally, and what Samesurf Co‑Browse is built to enable.

What Is Samesurf Co‑Browse?

Co‑browsing, short for collaborative browsing, lets support agents and customers navigate the same online content in real time without installs, downloads or IT involvement.

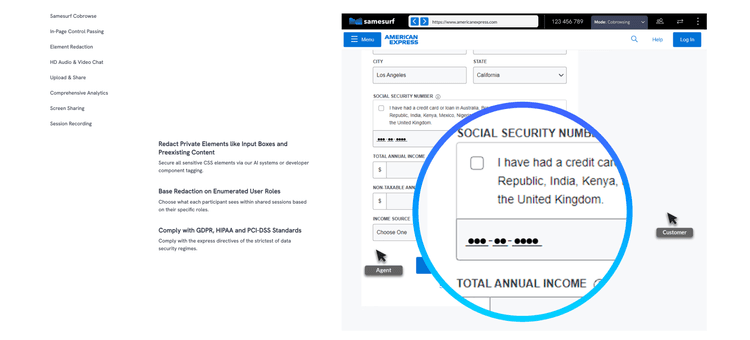

This method safeguards security via enterprise‑level encryption, single (or multiple tab) browser sharing and screen redaction for sensitive screen & input elements. Unlike typical (and risky) screen sharing systems, Samesurf co‑browse makes collaboration precise, secure and integrated directly within banking web experiences.

Use Case: Loan Applications Made Easy

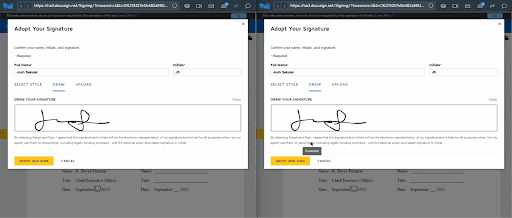

Loan applications can be daunting: lengthy forms, file uploads, and document verifications are quite verbose. However and with Samesurf Co‑Browse, loan officers can visually guide applicants step by step.

See what the applicant sees: Agents can view the exact same page and highlight fields while showing required documents and/or fixing errors in real time.

Reduce frustration and errors: No more back-and-forth emails. Samesurf co-browsing minimizes follow-up calls and emails by resolving issues in a single session.

Build trust: Transparency boosts credibility and customers feel glad with the knowledge that agents aren’t guessing. Actions are visible, which fosters confidence (samesurf.com).

This kind of personal, collaborative assistance is especially valuable during complex processes such as mortgage or business loan onboardings. Customers feel supported, banks reduce friction and conversion rates rise.

Transparent & Secure Advisory Sessions

Many banks offer digital advice platforms for investments, savings or insurance. However and without face to face interaction, these can feel impersonal and less than secure.

That’s where Samesurf co‑browse shines. Advisors can:

- Highlight portfolio dashboards and show asset performance in real time.

- Explain terms and compare products right beside clients during co‑browsing sessions in order to enhance transparency.

- Redact sensitive fields and control what’s visible so customer security is never compromised.

With co-browsing, clients don’t feel like they’re lost in numbers and they’re active participants. Such collaborative visual engagement can boost satisfaction by over 30% and first-call resolution rates by nearly 40%.

Support That Doesn’t Add Overhead

Customer support teams are often overwhelmed by repetitive support requests, password resets, document issues, and account queries. Samesurf co‑browse offers:

Faster resolutions: Agents diagnose and rectify problems visually in real time.

Lower ticket volume: One interactive session can resolve issues that otherwise might require multiple touchpoints.

Fewer escalations: With full context, agents feel more confident and effective at solving problems quickly.

The result? Lower operating costs, reduced support strain, and happier customers.

Co‑Browsing Across Every Device

One of the biggest challenges in digital banking is seamless cross-device experiences. Customers often switch between smartphone and desktop when handling banking tasks.

With Samesurf:

Mobile support is built in—agents can co‑browse on smartphones and tablets just as easily as on desktop.

No extra software or downloads are needed as sessions rely on standard web and port protocols.

Consistent experiences across devices means fewer usability issues and more reliable assistance – wherever and whenever the customer chooses to bank.

Security & Compliance Built‑In

Security isn’t optional in banking. It’s fundamental. Samesurf Co‑Browse includes enterprise-grade and regulatory controls:

Field redaction and input blocking ensure that sensitive data such as Social Security or Client Addresses is never exposed.

Encrypted sessions and role-based access architectures meet GDPR, HIPAA, PCI-DSS and ISO 27001 standards.

Auditable logs for compliance and training help banks maintain oversight and accountability.

All of this happens without slowing down the user experience or requiring heavy IT lift.

Amplified Trust & Business Outcomes

When institutions offer personalized, visual, and ultra-secure support via co‑browse, the impact is measurable.

Trust grows while improving long-term client relations and loyalty. Operational efficiency shoots up. Conversion and satisfaction metrics spike while there are fewer drop-offs.

In short, when financial institutions go beyond transactional support to offering fully guided service, both customers and institutions benefit.

Getting Started with Samesurf Co‑Browse

If your financial institution is ready to bring the human element back into digital banking, here are a few key steps:

Banking use cases – start with high-impact areas like loan origination, account onboarding, or investment advice.

Train agents and advisors – focus on best practices with regard to how to co‑browse discreetly, when to take control, and/or how to reinforce trust.

Embed co‑browse natively – integrate co-browse via REST APIs or the dashboard.

Promote the capability – let clients know they can get real-time visual assistance through reminders in your digital experiences.

Measure results – track resolution times, satisfaction rates, session counts, and adoption rates.

Conclusion

Real-world banking is built on relationships; yet, too often digital channels feel sterile. Samesurf Co‑Browse bridges that gap while enabling agents to walk customers through forms, documents, and decisions with precision, empathy and trust.

Across loan applications, advisory sessions, onboarding, and a plethora of support type interactions, the ability to co‑browse transforms customer experiences from “transactional” to “collaborative.” It streamlines operations, boosts security, raises satisfaction levels, and above all, renews the human connection that underpins financial relationships.

Visit samesurf.com to learn more or go to https://www.samesurf.com/request-demo to request a demo today.