Loan Forms Made Easy with Samesurf Cobrowse

August 18, 2025

Samesurf invented modern co-browsing.

In the world of finance, few processes are as critical, or as often fraught with friction, as the completion of a loan application. For financial institutions, the complexities of these forms can lead to high abandonment rates, frustrated customers, and increased operational costs. For customers, the experience can be intimidating and confusing, a daunting maze of jargon, data entry, and procedural hurdles. In an era where customer experience is a primary differentiator, relying on traditional support methods like phone calls or email is no longer sufficient. These channels often lead to miscommunication, prolonged back-and-forth, and an overall sense of helplessness for the customer.

Samesurf cobrowse is a modern marvel designed to bridge the digital divide between financial institutions and their clients. Samesurf, the top cobrowse solution allows a financial advisor or a customer service agent to literally join a customer on their journey through an online loan form. This isn’t just about passive observation; it’s about real-time, interactive collaboration. The advisor can see exactly what the customer sees, provide guidance, highlight key fields, and even assist with data entry—all within a secure, privacy-protected environment. This powerful tool transforms the tedious, solitary task of filling out a loan application into a guided, collaborative experience. It’s a game-changer that not only simplifies the process for the customer but also streamlines operations and strengthens relationships for the institution. By turning a moment of potential frustration into an opportunity for personalized, human-centered service, a top cobrowse solution like Samesurf cobrowse, makes loan forms easy and accessible for everyone.

The Problem with Traditional Loan Applications

The typical online loan application process is a minefield of potential problems. From the moment a customer opens the form, they are faced with a series of cognitive hurdles. They must decipher complex financial terminology, gather an array of personal documents, and accurately enter sensitive information. This self-service model often leaves customers feeling isolated and unsupported. When they hit a snag, their only recourse is often to pick up the phone, a process that can lead to its own set of frustrations. The customer attempts to verbally describe what they see on their screen, while the agent tries to visualize it based on a verbal description—a recipe for misunderstanding and extended call times. This friction often results in:

- High Abandonment Rates: Customers who encounter a difficult question or a technical issue are more likely to simply give up rather than navigate a frustrating support process.

- Increased Errors: Without real-time guidance, customers may enter incorrect information, leading to delays, reprocessing, and a negative customer experience.

- Inefficient Support: Agents spend valuable time on long calls, trying to troubleshoot issues they can’t see, which drives up operational costs.

These challenges highlight a critical need for a more intuitive, user-friendly approach. The solution is to provide a “copilot” for the customer, someone who can guide them through the process in real time. This is the exact role a top cobrowse solution like Samesurf fills, offering a direct line of sight and shared control that is simply impossible with traditional methods.

How a Top Cobrowse Solution like Samesurf Makes Loan Forms Easy

Samesurf, the top cobrowse solution, fundamentally changes the dynamic of the loan application process. Instead of a lone customer battling a complex form, it becomes a guided, two-person effort. The core of this technology is its ability to create a secure, synchronized browsing session that is seamless and intuitive for both the agent and the customer.

Here’s how Samesurf’s top cobrowse solution transforms the process:

- Real-Time, Visual Guidance: An agent can initiate a session from within a chat or phone call, and with the customer’s permission, instantly see their screen. This eliminates the need for verbal descriptions of the interface. The agent can use a shared cursor and annotation tools to point out exactly where the customer needs to click, what information they need to provide, or how to navigate to the next section.

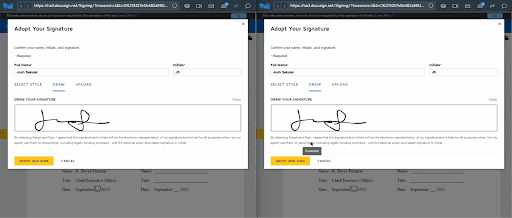

- Simplified Data Entry: For customers struggling with specific fields, the agent can, with permission, assist in filling out the information. This is particularly helpful for complex data points or when the customer is unsure what information is required. This collaboration ensures accuracy and speeds up the process significantly.

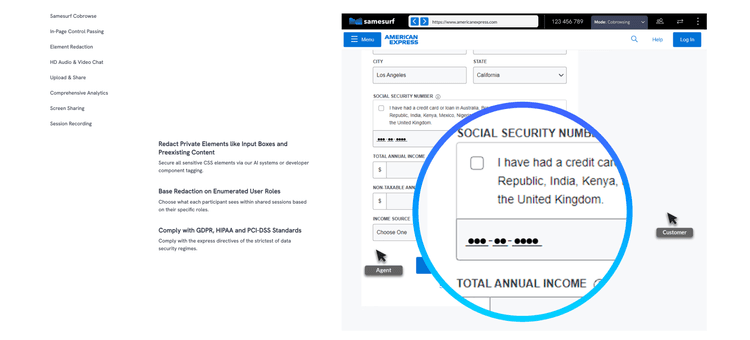

- Security and Privacy: In the financial industry, security is paramount. A top cobrowse solution like Samesurf cobrowse is designed with this in mind, offering critical features that protect customer data. Unlike screen sharing, it only shows the content within the specific browser tab, keeping the customer’s entire desktop and other open applications private.

- Data Masking: A key feature of Samesurf’s top cobrowse solution is the ability to automatically mask sensitive information, such as social security numbers, credit card details, or passwords, from the agent’s view. This ensures compliance with regulations and builds customer trust.

- Permission-Based Control: The customer is always in complete control. They must grant permission for the agent to view or interact with their screen and can end the session at any time.

This collaborative approach not only makes the process easier for the customer but also empowers the agent. They have the visual context they need to be more efficient and effective, leading to a more satisfying outcome for everyone involved.

The Benefits for Financial Institutions

The implementation of Samesurf’s top cobrowse solution offers far-reaching benefits for financial institutions that extend beyond simply making loan forms easier. By enhancing the customer experience, they can achieve measurable improvements in key areas.

- Increased Completion and Conversion Rates: By removing friction and providing real-time support, cobrowsing significantly reduces the likelihood of form abandonment. Customers are more likely to complete their applications when they have a trusted advisor guiding them through the process, which directly boosts loan conversion rates.

- Improved Agent Efficiency: With visual context, agents can resolve issues much faster, reducing average handle time (AHT). This efficiency allows them to assist more customers per day and focus their efforts on building relationships rather than troubleshooting. This boosts first call resolution (FCR), a critical metric for customer satisfaction and operational excellence.

- Enhanced Customer Loyalty: A positive, effortless experience during a high-stakes process like a loan application leaves a lasting impression. Customers who feel supported and valued are more likely to return for future business and recommend the institution to others. Cobrowsing humanizes a digital process, fostering the kind of loyalty that is invaluable in a competitive market.

- Compliance and Security: The security features built into a top cobrowse solution are crucial for meeting stringent financial regulations. By ensuring that sensitive data is masked and that all sessions are permission-based, institutions can provide a superior experience while maintaining full compliance.

In conclusion, the days of expecting customers to navigate complex digital forms on their own are over. The advent of cobrowsing technology, and specifically a top cobrowse solution like Samesurf, provides a powerful and elegant way to simplify the loan application process. It’s a tool that empowers financial institutions to move beyond simple support and towards a model of true collaboration and partnership. By making loan forms easy, a top cobrowse solution doesn’t just improve efficiency—it builds the trust and loyalty that form the bedrock of successful, long-lasting customer relationships.

Visit samesurf.com to learn more or go to https://www.samesurf.com/request-demo to request a demo today.